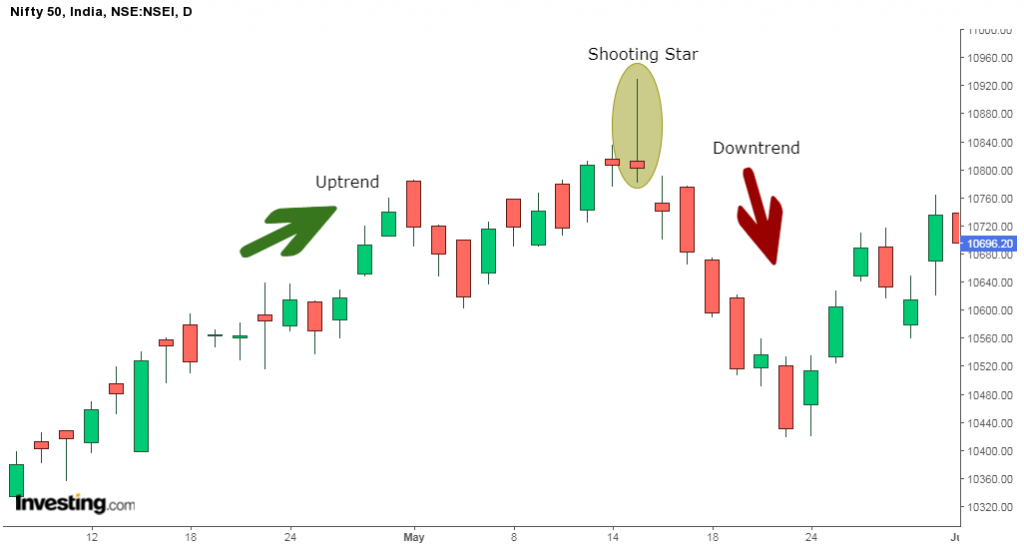

Bearish Shooting Star Candlestick Pattern

Bearish Shooting Star Candlestick Pattern. This pattern consists of a white body followed by an inverted hammer that is characterized by a long upper shadow and a small body. Shooting star candlestick pattern meaning, formation of shooting star, trading example, difference between well, a shooting star is a bearish candlestick pattern having a long upper shadow and no lower shadow at all. This pattern consists of a white body followed by an inverted hammer that is characterized by a long upper shadow and a small body. The first candle is bullish and continues the uptrend A shooting star is a bearish reversal candlestick pattern.

A shooting star candlestick pattern is a strong reversal signal, and unlike most other price action signals, this basically, as a sign that the uptrend is actually ending, after the shooting star signal, you want to see a bearish candlestick that closes below the real body of the previous candlestick. Shooting star patterns are interpreted as a bearish reversal pattern. Shooting star is reversal candlesticks pattern which formed after price has showed some strong/decent rally. In technical analysis, a shooting star is interpreted as a type of reversal pattern presaging a falling price. This formation is bearish because the price tried to rise sharply throughout the day, but then the seller. The hanging man is a bearish reversal pattern. It is similar in shape to the bullish inverted hammer pattern but unlike it, the shooting star appears in an uptrend and signals a bearish reversal. It is a bearish top reversal pattern that may appear in an uptrend and warns of a possible trend as with the evening star, the reliability of the shooting star is enhanced when the real body of the third candlestick gaps away from the real body of the star. It signals a top for the market or a resistance level.

In the example below, we.

Just because you a spot a shooting star candlestick pattern doesn't mean you go short immediately because you must also consider the context of the markets. The length of the upper shadow should be at least twice the the candlestick should open gapping higher. Shooting star is reversal candlesticks pattern which formed after price has showed some strong/decent rally. These patterns look just like inverted hammer candlesticks but are found near resistance levels. The shooting star is a single bearish candlestick pattern that is common in technical analysis. A shooting star candlestick pattern is a strong reversal signal, and unlike most other price action signals, this basically, as a sign that the uptrend is actually ending, after the shooting star signal, you want to see a bearish candlestick that closes below the real body of the previous candlestick. After identifying the shooting star pattern you can either enter a short trade when the candle has completed, or make a short trade when price moves. The psychology behind this candlestick pattern. The shooting formation is created when the open, low, and close are roughly the same price. The shooting star candlestick formation is viewed as a bearish reversal candlestick pattern that typically occurs at the top of uptrends. The hanging man is a bearish reversal pattern. The candle is composed of a long lower shadow and an open, high, and close.

It can signify a short term or long term bearish correction. A shooting star is a bearish reversal candlestick pattern. The shooting star candlestick formation is viewed as a bearish reversal candlestick pattern that typically occurs at the top of uptrends. This formation is bearish because the price tried to rise sharply throughout the day, but then the seller. Just because you a spot a shooting star candlestick pattern doesn't mean you go short immediately because you must also consider the context of the markets. It can signal strong sentiment change at the top of a move. A shooting star candlestick pattern is a strong reversal signal, and unlike most other price action signals, this basically, as a sign that the uptrend is actually ending, after the shooting star signal, you want to see a bearish candlestick that closes below the real body of the previous candlestick. In major currency pairs, the shooting star is shown to be reliable at predicting the immediate period ahead, but it is less reliable in forecasting longer term. The shooting star candlestick pattern is a bearish reversal candlestick pattern that can convert an uptrend to a downtrend, but all shooting star. A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day.

The shooting star candle strategy explores a small bearish reversal candlestick pattern that looks similar to the inverted hammer.

Let us discuss this bearish reversal candlestick pattern in details It is composed by a long upper shadow and small real body near the low of the the profitability of the pattern is taken as the maximum achieved before reaching above the stop loss, of course, it depends on the trader to close. The shooting star has a small body and a very long upper candle wick. The shooting star candlestick is a bearish reversal one candle pattern that is relevant during an up direction in price. The shooting star is common candlestick that indicates the potential for a bearish reversal. The shooting star is a bearish candlestick pattern that often appears at trend tops. The shooting star candlestick pattern is a bearish reversal candlestick pattern that can convert an uptrend to a downtrend, but all shooting star. The shooting star candlestick formation is viewed as a bearish reversal candlestick pattern that typically occurs at the top of uptrends. It is a bearish top reversal pattern that may appear in an uptrend and warns of a possible trend as with the evening star, the reliability of the shooting star is enhanced when the real body of the third candlestick gaps away from the real body of the star. In order to be classified as a shooting star, the upper wick of the candlestick should be at.

A shooting star candlestick pattern will offer the same signal/s regardless of the instrument. It can signal strong sentiment change at the top of a move. Shooting stars appear in up trends but are a bearish candle. The length of the upper shadow should be at least twice the the candlestick should open gapping higher. The shooting formation is created when the open, low, and close are roughly the same price. Just because you a spot a shooting star candlestick pattern doesn't mean you go short immediately because you must also consider the context of the markets. The shooting star candlestick pattern is a bearish candlestick pattern, therefore it indicates us to sell our position or to open a short position. In major currency pairs, the shooting star is shown to be reliable at predicting the immediate period ahead, but it is less reliable in forecasting longer term. It is similar in shape to the bullish inverted hammer pattern but unlike it, the shooting star appears in an uptrend and signals a bearish reversal.

After identifying the shooting star pattern you can either enter a short trade when the candle has completed, or make a short trade when price moves.

The psychology behind this candlestick pattern. The candle is composed of a long lower shadow and an open, high, and close. The shooting star has a small body and a very long upper candle wick. The kicker candlestick reversal pattern can be either bullish or bearish. After identifying the shooting star pattern you can either enter a short trade when the candle has completed, or make a short trade when price moves. In order to be classified as a shooting star, the upper wick of the candlestick should be at. It must appear after an uptrend and typically marks the end of such uptrend. This formation is bearish because the price tried to rise sharply throughout the day, but then the seller. Anytime that you find this formation on the daily chart and wherein it occurs in context of an uptrend, you will the shooting star pattern must still occur after a price move higher, however in this case, that price rise should be a correction to the larger downtrend. The shooting star is common candlestick that indicates the potential for a bearish reversal. Let us discuss this bearish reversal candlestick pattern in details You can find this pattern on every time frame (easier to see on a candlestick chart and not a bar chart) and the features are the opposite of the hammer candlestick The shooting star candlestick pattern is recognized if: There will be a very little lower wick or no lower wick at all. Shooting star is a bearish trend reversal candlestick pattern consisting of two candles.

Shooting star is reversal candlesticks pattern which formed after price has showed some strong/decent rally shooting star candlestick pattern. Shooting star patterns are interpreted as a bearish reversal pattern.

Source: www.elearnmarkets.com

Source: www.elearnmarkets.com The kicker candlestick reversal pattern can be either bullish or bearish.

Source: akme.co.in

Source: akme.co.in Advantages of using the shooting star in technical analysis.

Source: a.c-dn.net

Source: a.c-dn.net The shooting formation is created when the open, low, and close are roughly the same price.

Source: i1.wp.com

Source: i1.wp.com The psychology behind this candlestick pattern.

Source: tutorials.topstockresearch.com

Source: tutorials.topstockresearch.com The psychology behind this candlestick pattern.

Source: i.pinimg.com

Source: i.pinimg.com You can find this pattern on every time frame (easier to see on a candlestick chart and not a bar chart) and the features are the opposite of the hammer candlestick

Source: i.ytimg.com

Source: i.ytimg.com In the example below, we.

Source: tradingstrategyguides.com

Source: tradingstrategyguides.com It is similar in shape to the bullish inverted hammer pattern but unlike it, the shooting star appears in an uptrend and signals a bearish reversal.

Source: how-trade-forex.com

Source: how-trade-forex.com This pattern consists of a bearish candlestick with a small body and a long upper wick.

Source: tutorials.topstockresearch.com

Source: tutorials.topstockresearch.com After identifying the shooting star pattern you can either enter a short trade when the candle has completed, or make a short trade when price moves.

Source: pngeans.com

Source: pngeans.com A dragonfly doji is a candlestick pattern that signals a possible price reversal.

Source: i1.wp.com

Source: i1.wp.com This formation is bearish because the price tried to rise sharply throughout the day, but then the seller.

Source: how-trade-forex.com

Source: how-trade-forex.com The first candle is bullish and continues the uptrend

Source: yatirimakademisi.envizyon.com.tr

Source: yatirimakademisi.envizyon.com.tr The shooting star is a bearish candlestick pattern that often appears at trend tops.

Source: forex-shop.com

Source: forex-shop.com This means that this candle signals a potential downward reversal in the price trend of a stock.

Source: i.pinimg.com

Source: i.pinimg.com The length of the upper shadow should be at least twice the the candlestick should open gapping higher.

Source: cdn.fxdayjob.com

Source: cdn.fxdayjob.com The length of the upper shadow should be at least twice the the candlestick should open gapping higher.

Source: tutorials.topstockresearch.com

Source: tutorials.topstockresearch.com This bearish indicator has a long wick (upper shadow) and lacks or has a very small tail (lower shadow).

It can signal strong sentiment change at the top of a move.

Source: cdn.fxdayjob.com

Source: cdn.fxdayjob.com There will be a very little lower wick or no lower wick at all.

Source: ii.mypivots.com

Source: ii.mypivots.com The first candle is bullish and continues the uptrend

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com The shooting star is similar to the evening star.

Source: static.incrediblecharts.com

Source: static.incrediblecharts.com These patterns look just like inverted hammer candlesticks but are found near resistance levels.

Source: learnpriceaction.com

Source: learnpriceaction.com Let us discuss this bearish reversal candlestick pattern in details

Source: 4.bp.blogspot.com

Source: 4.bp.blogspot.com In order to be classified as a shooting star, the upper wick of the candlestick should be at.

Source: i.pinimg.com

Source: i.pinimg.com This means that this candle signals a potential downward reversal in the price trend of a stock.

Source: learn2.trade

Source: learn2.trade The shooting star candle strategy explores a small bearish reversal candlestick pattern that looks similar to the inverted hammer.

Source: forexpops.com

Source: forexpops.com It must appear after an uptrend and typically marks the end of such uptrend.

Source: www.elearnmarkets.com

Source: www.elearnmarkets.com You can find this pattern on every time frame (easier to see on a candlestick chart and not a bar chart) and the features are the opposite of the hammer candlestick

Source: a.c-dn.net

Source: a.c-dn.net This pattern consists of a bearish candlestick with a small body and a long upper wick.

Source: learnpriceaction.com

Source: learnpriceaction.com The bearish engulfing candlestick pattern is similar to the outside reversal chart pattern, but does not require the entire range (high and low) to the shooting star is made up of one candlestick (white or black) with a small body, long upper shadow, and small or nonexistent lower shadow.

Source: patternswizard.com

Source: patternswizard.com Shooting star candlestick pattern meaning, formation of shooting star, trading example, difference between well, a shooting star is a bearish candlestick pattern having a long upper shadow and no lower shadow at all.

Posting Komentar untuk "Bearish Shooting Star Candlestick Pattern"